imaginima/E+ via Getty Images

Boston Real Estate (NYSE: New York Stock Exchange: BXP) is a developer and owner of Class A office properties in the USA. The company focuses on six markets: San Francisco, Los Angeles, New York, Seattle, Boston, and Washington, DC. It is organized as a Real Estate Investment Trust (REIT .).) that manages, acquires and develops office properties in the areas of your choice. The company’s portfolio includes 196 properties and more than 50 million square feet of property.

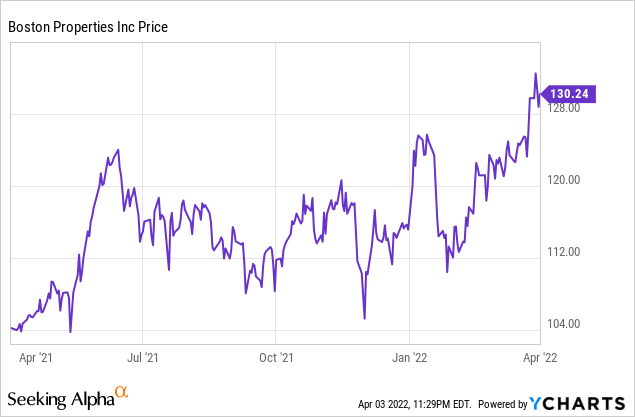

ycharts.com

In this article, I will show that although the value of the company may rise in the next 12-18 months, as a long-term position, Boston Properties is not the best option in its sector, and this stock is getting a neutral position in my country. the book.

Office real estate market

Since the start of the COVID 19 pandemic, the demand for office space has dropped dramatically. Over the past few months, governments have lifted restrictions, and companies have begun allowing their employees to return to work.

Despite the lifting of restrictions, there is still uncertainty about what the future holds for desk-top REITs. Unlike REITs for homes and apartments, developments held by Boston Properties are not a necessity for the community to operate. People need homes to live in, not offices to work in. This leaves uncertainty about the future and makes stable markets usually have a higher short-term beta than expected.

One advantage of office REITs is that they usually have long-term lease agreements that provide steady cash flow. However, the purchase or development of such large real estate is becoming increasingly expensive. As supply chain problems approach, projects usually go overtime, over budget, and reduce profits and cash flow. This reduces the company’s return on investment and reduces profitability.

I feel that the value of the properties owned by Boston Properties will underperform compared to the rest of the market. The primary cities the company maintains are not in strategic locations, and mass American immigration from California, New York and other traditionally cold, democratic countries to states like Texas, Georgia and Florida, which have much better tax rates and job opportunities. Real estate prices are determined by two primary factors: supply versus demand and location. With lower demand, especially for office properties in higher-tax areas, Boston Properties’ revenue can decline and drive rents lower, thus reducing profits. Boston Properties needs to expand into untapped Southeast markets to increase shareholder value.

Owen Thomas, CEO of Boston Properties, has resisted similar claims, telling CNBC in early March:

“Companies are saying, look, we don’t want to work from home. We want our employees to be in a physical office, so we go to the cost and expense of renting something in the suburbs on a short-term basis so we can put them all together”

It remains to be seen if he is right or not. But there is no doubt that the company is on the defensive at the moment.

solid financial

Boston Properties has a P/FFO of 18.65 in 2021 and a forecast P/FFO of 16.56 in 2021. This is roughly in line with what is expected in the industry, with a sector forward P/FFO total of 16.47. While this does not detract from Boston Properties as an investment, it certainly does paint a picture of a company with tremendous value to be found at current prices. It is expected to generate revenue of $3.04 billion in 2022 (4.50% growth) with average earnings per share of 0.67. These metrics show that stable growth is expected; However, long-term revenue forecasts are murky as the company attempts to shift the type of real estate it’s buying from purely office real estate to media centers and life sciences buildings.

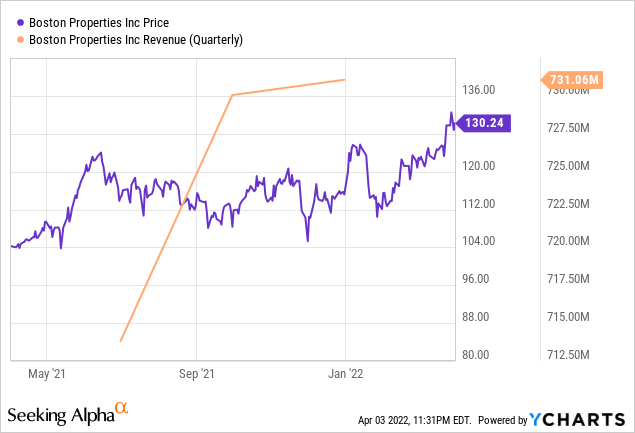

ycharts.com

As stated in my post, I do not despise the company’s outlook. BXP pays out a dividend of $3.92 per share (about 3.10%) annually, which is well below the average REIT available in the market. Many REITs can pay healthy dividends at 4-6 percent annually, with some as high as the 8-10 percent mark. Investors will not have to look far to get a better total return in the short and long term.

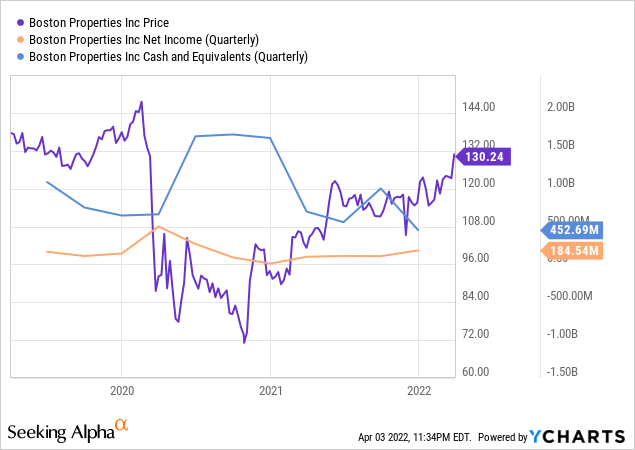

BXP’s earnings actually declined in 2021, although many other sectors and companies within the real estate sector experienced explosive growth. The company’s 2021 profit was $505 million, well below $850 million in 2020 and below pre-pandemic levels in 2018 and 2019, which were 582 and 521 million, respectively. This is a huge red flag when investing in a REIT; This may indicate that they are investing in areas and types of real estate that are losing demand quickly. The instability of a company’s earnings, combined with the fact that any REIT must pay 90% of its taxable income, may be a concern for some investors if there is a downturn in the market because the company may not have enough cash on hand to handle the headwinds adequately. effective. There are many companies in the real estate sector with better cash flow, better dividends, and a better market, which makes BXP undesirable at current prices.

ycharts.com

The BXP’s total debt to total assets ratio is 59.67, which is a pretty high number even for REITs. This puts pressure on their business to find clients to rent out their offices for the long term because they do not have much equity in their property. Also, REITs with lower stocks are also not able to maneuver in times of financial crisis and are more prone to default. The company’s cash and short-term investments decreased by more than 70% in 2021; There will be no major investments in the near future to take BXP to the next level. While this metric is not critical, it can give insight into the company’s short-term direction and potential pitfalls. The best companies to invest in have a large cash flow not only for emergencies but also to take advantage of opportunities that may arise in their markets.

Risks

When any company changes its direction, it carries the element of risk and requires a lot of money to implement it. Specifically, mistakes are expensive in the real estate market because once development plans are in place, and the first concrete is poured, the job must continue to completion. Even purchasing already built buildings can be risky as demographics change and other businesses change the way they operate. In many ways, Boston Properties is at the mercy of other companies and what they want to do with their employees. Personally, I prefer investing in companies that get business proactively rather than trying reactively and building it.

Future growth and fast food

Boston Properties is a solid company, trading in P/FFO in line with its competitors, stable growth expected in the short term. However, in the long run, BXP may have problems finding clients, increasing revenue, and managing debt. On a yearly basis, the company’s revenue has declined and is not recommended as a good long-term hold with better options available in the market. In order to succeed, Boston Properties will have to start investing in the southern regions of the United States – states like Florida and Texas, where people and eventually jobs are flocking in greater numbers every year. Investing in these areas will be critical to achieving strong margins and good cash flow going forward. This cash flow can be used to increase and maximize dividend payouts and provide more value to shareholders. Shareholder value is critical as more investors are flocking to apartment and condo REITs to business and office REITs.