Back in early 2020, as the coronavirus pandemic began sweeping across the US, the number of Google searches related to mortgages soared — in a sign back, I predicted a so-called major redistribution as people moved to greener pastures.

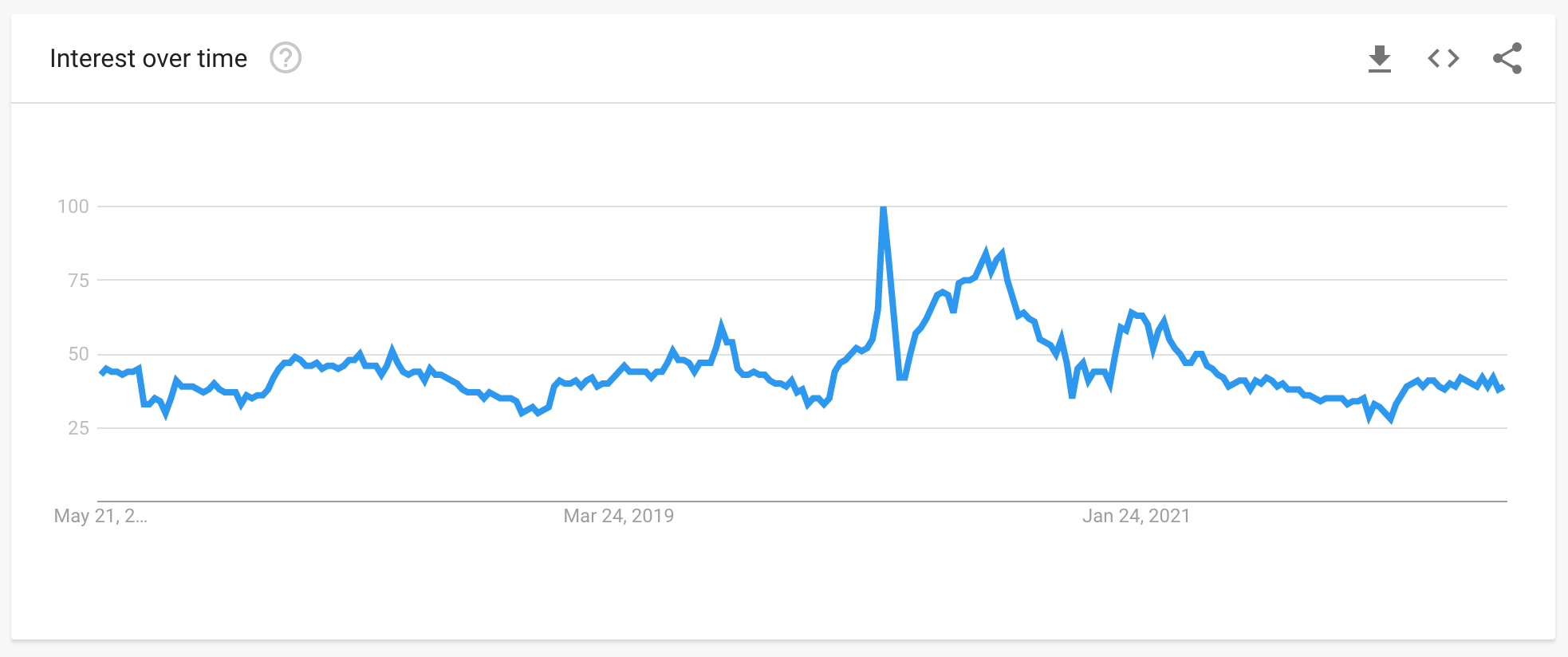

A year later, in the spring of 2021, and then again in the spring of this year, searches on Google for the term “bidding wars” increased.

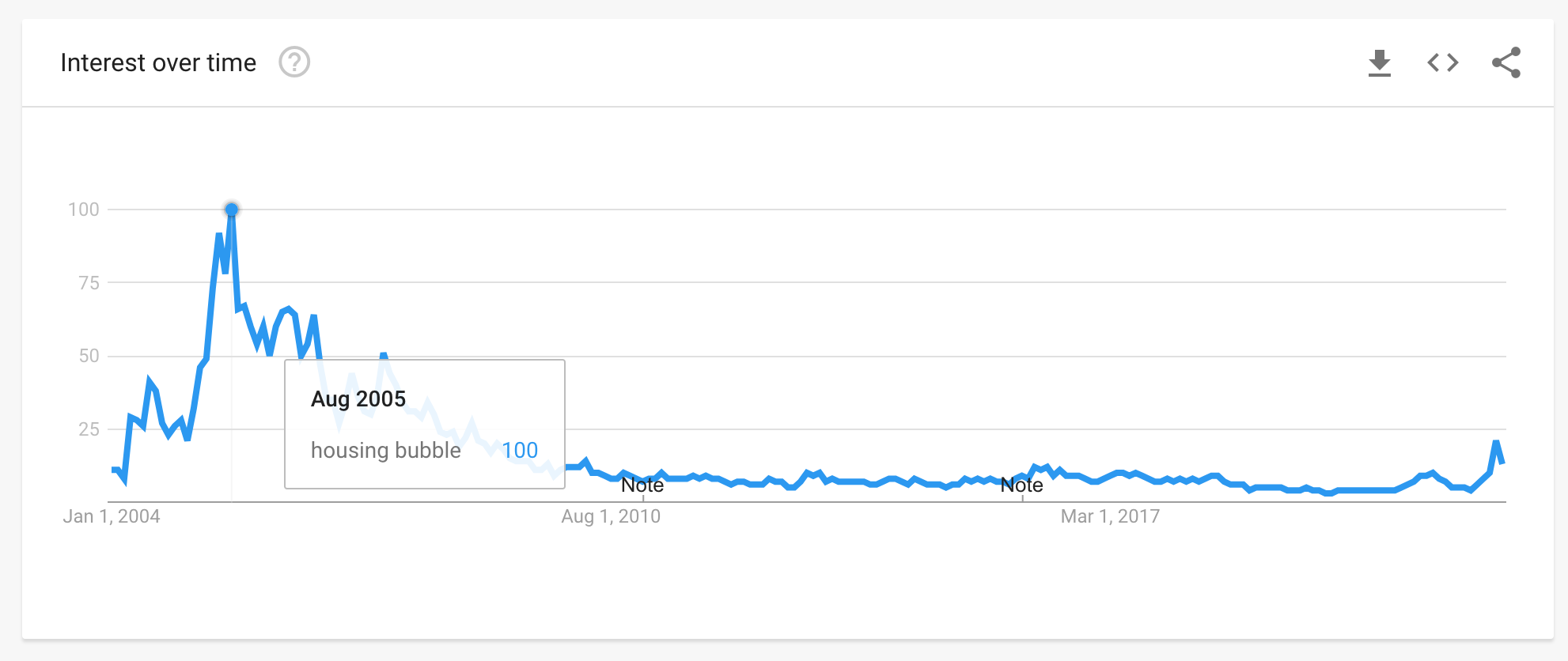

But perhaps the most intriguing recent spike in Google searches has been a more perilous term: “housing bubble.”

This is all according to Google Trends, which allows users of the platform to select popular search terms. For example, you can enter the name “Will Smith” into the tool and notice that Google searches for the actor went up right after he slapped Chris Rock at the Academy Awards. Google uses a relative scale when representing the number of searches performed, so searches for Will Smith have been hovering around zero over the past five years, but have risen to a maximum of 100 after the Oscar slap.

It only makes sense that Google searches for Will Smith would increase after a high-profile incident. But the most powerful use of Google Trends is as a measure of interest in other topics that should be vying for attention in a crowded market. For example, Google Trends shows that searches for “Ukraine” rose when the war began earlier this year, but have since fallen off — suggesting that the conflict isn’t getting as much attention from Americans as it once was. This shift in attention was not a clear or imposed consequence.

In the same way, Google Trends provides a useful window into consumers’ concerns, interests, and concerns. At the moment, the potential housing bubble appears to be the biggest fear. Specifically, Google Trends shows that searches for the term “housing bubble” have remained relatively flat over the past five years and even declined earlier during the coronavirus pandemic. However, this spring, searches for that term shot up.

The surge occurred precisely in late March. This more or less coincided with the start of the spring market, so some of the upside may have been reflected simply as more consumers getting their heads around as they prepared to jump into the market. On the other hand, recent years haven’t seen similar spikes in “housing bubble” searches, so there must be something unique going on here.

In addition, the rise appears to be in line with the release of a report from the Federal Reserve in Dallas – as well as media coverage of the report – which indicated “abnormal behavior in the US housing market for the first time since the early 2000s boom, which found evidence of a” bubble American housing is brewing.”

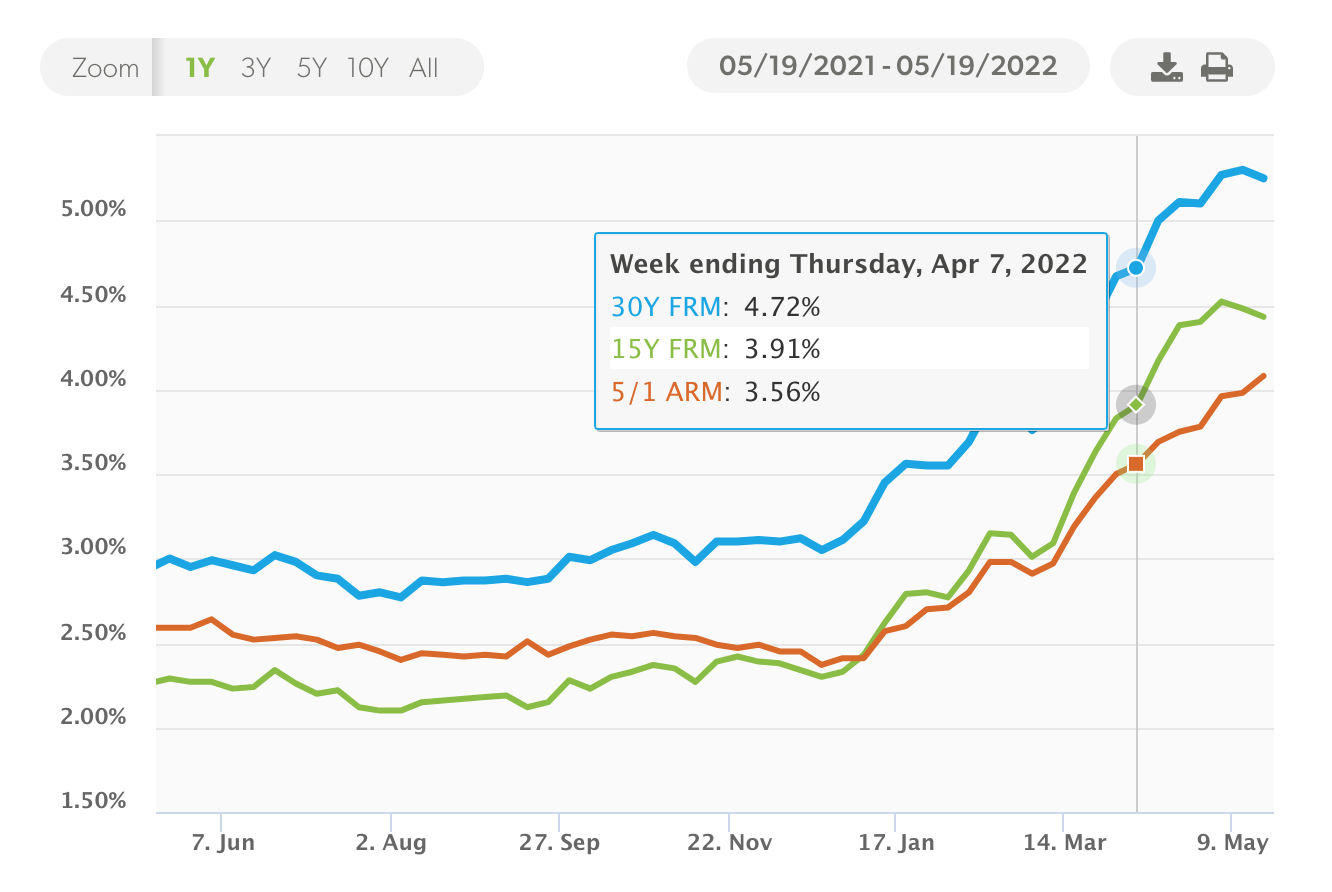

The other thing that happened at the same time as people were doing more bubble-related searches on Google was a rapid jump in mortgage rates. According to Freddie Mac, the average 30-year flat-rate mortgage rate on March 3 was 3.76 percent. By March 31, the average jumped to 4.67 percent. The average then continued to rise until May.

Credit: Freddy Mac

It is not clear if there is any direct relationship between higher prices and increased searches on Google for topics related to bubbles. All that can be said definitively is that both things happened at the same time. However, it is easy to imagine that buyers are suddenly feeling the pressure of rising prices and wondering – perhaps hoping in some cases – that home prices will fall again.

It should also be noted that searches for things like “mortgages” and “bid wars” have roughly followed up with reality over the past couple of years. In the same way that searches for “Will Smith” reflect an actual news event, searches for real estate terms seem to reflect consumers’ attitudes about the market. Case in point, at the start of the pandemic, interest rose to search not only for the term “mortgages” but also for “home loan” and “mortgage calculator.” The next two years were a fortune from consumers who took out mortgage loans.

Credit: Google

On the other hand, the hypothesis that search traffic somehow reflects real-world trends becomes troubling, in light of the growing interest in research in the housing bubble.

Since March, research interest in the term “housing bubble” has fallen significantly from its highest point. However, interest in the topic remains high compared to most of the recent past. During the week of May 8-14, for example, search interest in the term “housing bubble” was higher than at any other time in the past five years except for a massive spike in March.

However, the good news is that when you look at searches for “housing bubble” since 2004 – the maximum range Google offers – the surge in searches today doesn’t look so bad. In fact, 2005, when home prices were on the rise but the bubble had not yet burst, was actually the highest point in Google searches on the subject, with interest far exceeding what is happening today.

Research interest in the term “housing bubble” peaked in 2005. Credit: Google

It is important to reiterate here that of course Google searches about the housing bubble do not cause bubbles, nor do they reflect hard or specific economic data. It is a glimpse into a collective mood.

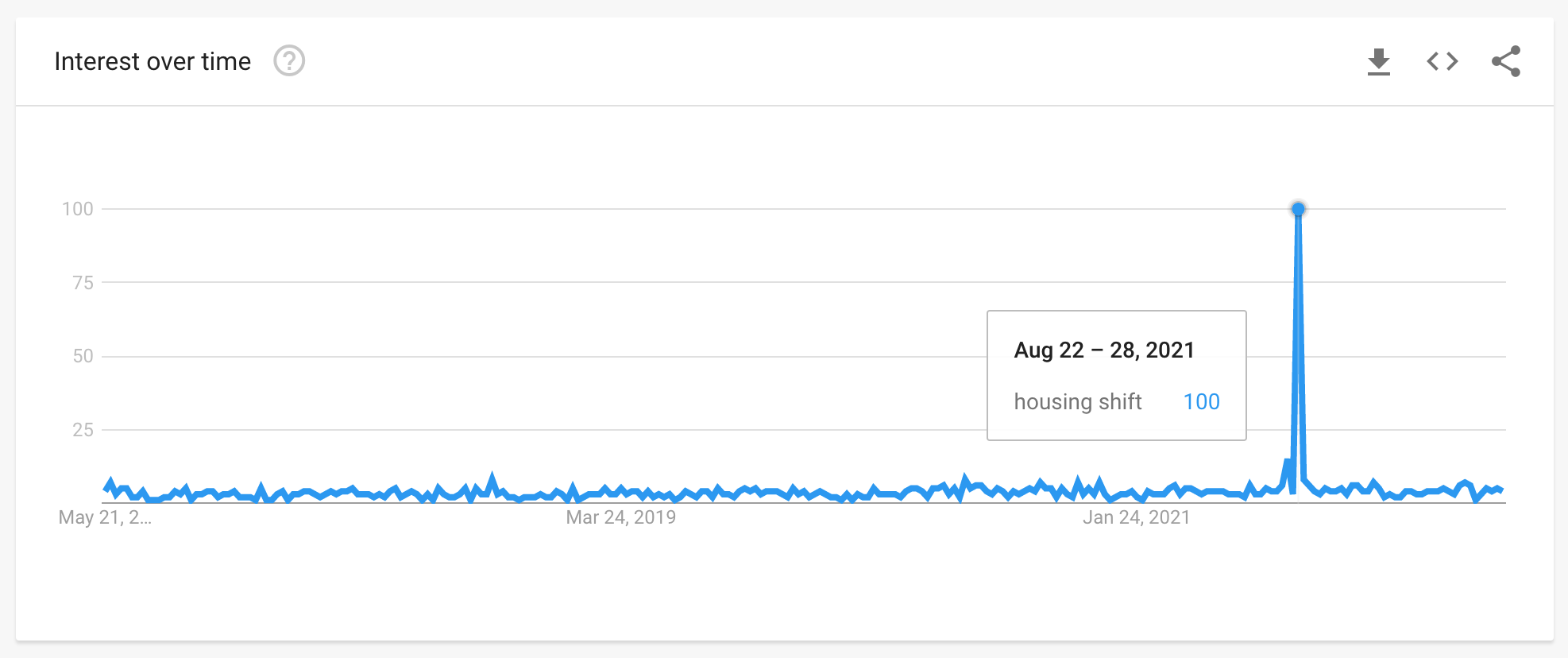

Other search terms suggest that consumers are at least curious about the direction the housing market is heading. Around the time that searches for “housing bubble” were booming, for example, Google also saw increased interest in the term “house prices.” And last August, there was a brief but meaningful spike in searches for the term “housing transition.”

Google has been searching for “housing transformation” for the past five years. Credit: Google

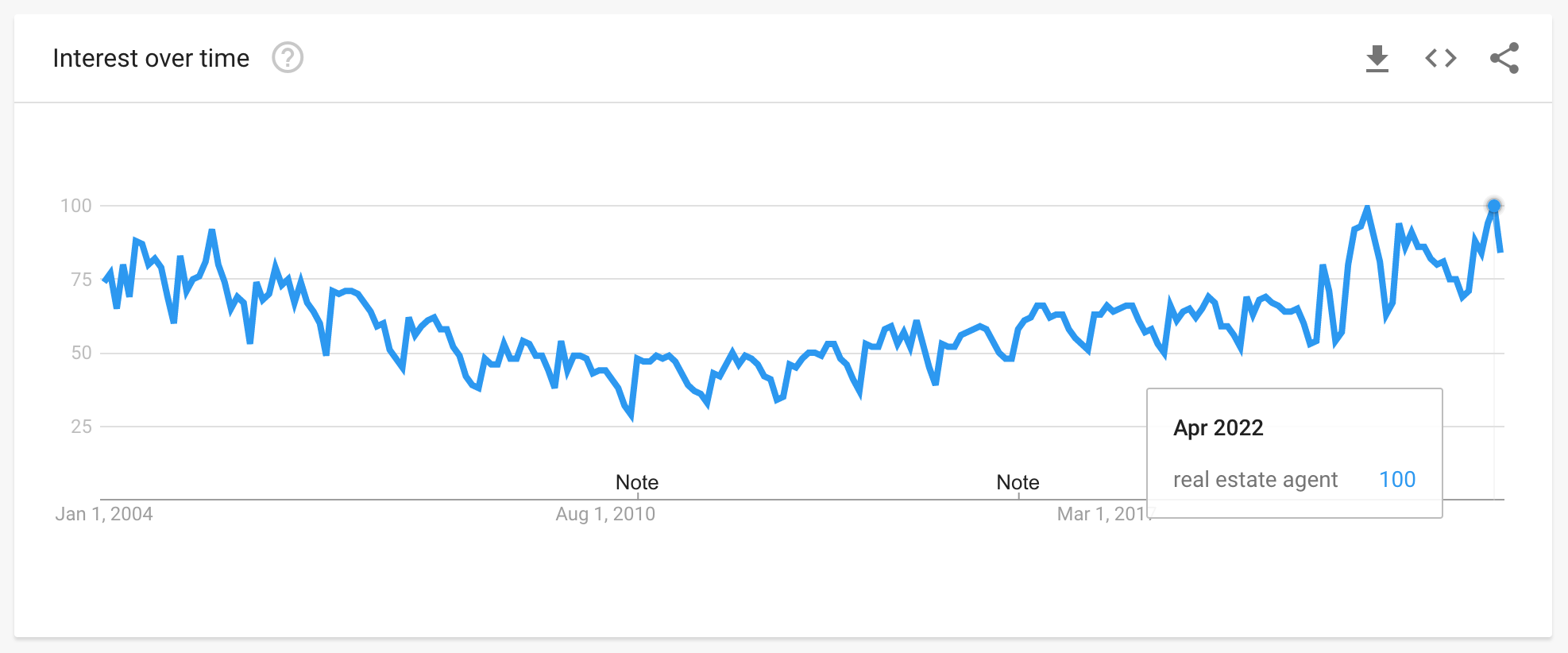

On the other hand, some terms have remained relatively constant over time. For example, searches for the word “Realtor” have been cyclical with the market over the past five years, but overall they haven’t seen significant highs or lows. Searches for the phrase “real estate agent” followed a similar pattern but are actually higher now than in the past – a finding that one can extrapolate as evidence that people still want to work with agents.

Google has been searching for “real estate agent” since 2004. For Credit: Google

The interest in the term FHA followed a similar pattern, indicating that real estate consumers are still looking for loans geared toward first-time buyers.

Perhaps most intriguingly, searches for “real estate commissions” have fallen a lot compared to their pre-Great Recession highs. Such a finding suggests that despite ongoing and contentious litigations over agent wages, and despite persistently rising housing prices, consumers are not particularly concerned about their agents’ costs or how those costs intersect with housing affordability.

The picture that emerges from all this data is one in which consumers are still interested in buying and selling homes, even with some concern about shifts and bubbles. This is an image that is mostly tracked by the latest economic analysis. For example, a few days ago, Fannie Mae noted that relative to median incomes, home prices “have now deviated from the historical norm more than their peak in 2006.”

“We believe this indicates an unsustainability of current home prices relative to long-term fundamentals, and with interest rates rising, it points to strong downward pressures on continued home price appreciation,” Fannie Mae economists said in their latest Economic Outlook.

However, economists at Fannie Mae do not expect a repeat of the 2008 housing bubble.

Earlier this month, Lawrence Yun, chief economist at the National Association of Realtors, said the US could be headed into a “very unusual recession.” Yoon also weighed in on concerns about the bubble, telling real estate professionals that we “are not in excessive debt” — implying that conditions today are different from those that led to the bubble bursting in 2008.

Jeff Tucker, chief economist at Zillow, recently expressed skepticism about the bubble, but hinted that bubble talk and the resulting fear could actually be a drag on the housing market.

Tucker wasn’t talking about Internet search traffic, but his view that gossip can affect the profile of the housing market is a relevant one. And while it is not yet clear what will happen in the coming weeks, months and years, there is no doubt that consumers have expressed their curiosity online about the changing market.

Email Jim Dalrymple II