A long-term investment can change your life when you buy and own truly great companies. And high-quality companies can see their stock prices grow by huge amounts. Just think of the smart investors who kept it Planet Fitness, Inc. (NYSE: PLNT) over the past five years, while up 363%. If that doesn’t prompt you to consider investing long-term, we don’t know what will. Last week, the stock price jumped 6.3%.

Last week it proved profitable for Planet Fitness investors, so let’s see if fundamentals drove the company’s performance for five years.

Check out our latest analysis on Planet Fitness

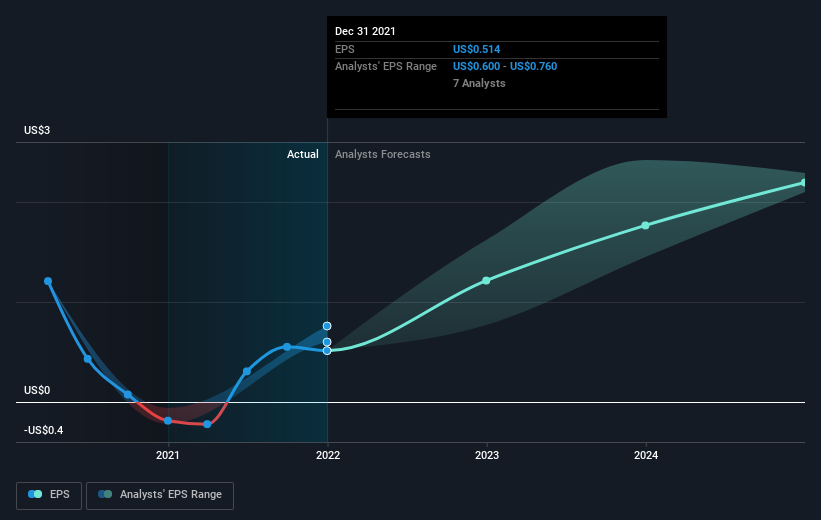

While markets are a powerful pricing mechanism, stock prices reflect investor sentiment, not just core business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and earnings per share (EPS).

For the past half decade, Planet Fitness has become profitable. This type of transition can be an inflection point that justifies strong gains in the stock price, just as we’ve seen here.

The company’s earnings per share (over time) are illustrated in the image below (click to see exact numbers).

We know Planet Fitness has improved its earnings lately, but will it increase revenue? If you are interested, you can check it out Free Report outlining revenue forecasts unanimously.

different perspective

While the broader market lost about 1.1% in the twelve months, Planet Fitness shareholders did worse, losing 2.3%. However, it could simply be that the stock price was affected by broader market anxiety. It can be helpful to keep an eye on the fundamentals if there is a good opportunity. Long-term investors won’t be upset, because they would have earned 36%, each year, over five years. If the fundamental data continues to point to sustainable long-term growth, the current sell-off may be an opportunity worth considering. It is always interesting to track the long-term performance of a stock’s price. But to better understand Planet Fitness, we need to consider many other factors. To this end, you must learn about 4 warning signs We’ve spotted with Planet Fitness (including 2 that are of concern).

If you want to buy shares along with management, you may absolutely love this Free List of companies. (Hint: Insiders buy it.)

Please note that the market returns mentioned in this article reflect the weighted average market returns of stocks currently traded on US stock exchanges.

Do you have feedback on this article? Worried about the content? keep in touch with us directly. Alternatively, email the editorial team (at) simplewallst.com.

This article by Simply Wall St is general in nature. We provide comments based only on historical data and analyst expectations using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, nor does it take into account your objectives or financial situation. We aim to provide you with focused, long-term analysis driven by essential data. Note that our analysis may not include the company’s most recent price-sensitive ads or quality materials. Wall Street simply has no position in any of the stocks mentioned.