Razvan / iStock Editorial via Getty Images

stadium elevator

My booking rating for The Walt Disney Company (NYSE: DIS) stock is unchanged from my previous DIS update published on December 15, 2021, highlighting the company’s $33 billion content spending for 2022. In the current article, I discuss whether Disney’s recently announced residential real estate project will affect its future financial performance.

Disney’s expansion into residential real estate shouldn’t have a significant impact on the company’s financial outlook at this time. Instead, the pace of the theme park’s recovery and its future spending on direct-to-consumer business, or DTC, should affect Disney’s business outlook to a much greater extent. Disney is expected to expand its bottom line earnings by +20.2% CAGR for the fiscal 2023-2025 time frame, and DIS’ FY 2023 P/E appears to be fair and reflects the company’s medium-term growth outlook. Since Disney stock prices don’t appear to have been mispriced, DIS’s Hold rating is appropriate.

What are the Disney communities that live the stories?

Last month, Disney released a media statement revealing that Cotino, Disney’s first Storyliving community, will be located in Greater Palm Springs and being built through a partnership with real estate developer DMB Development.

the artist An impression of what a cotino might look like

Disney

On the company’s Storyliving by Disney website, it describes DIS Cotino as a “voluntary club membership” that “provides access to a waterfront club, club-only beach area, and water-theme entertainment” and “Disney entertainment and activities year-round at an additional cost.” Activities that Disney plans to organize at Cotino and other future Storyliving communities will likely include “wellness programming,” “live shows,” and “cooking classes,” to name a few as described in the company’s press release.

To better understand Disney’s Storyliving communities, it may be helpful to go back in history and review the company’s past residential real estate projects.

Disney’s first “urban planning project, a city conceived, designed and built around Walt Disney” that bragged about the so-called “Disney-style fantasy architecture” a celebration It was built in 1996 according to the book Disney culture Written by John Wells. In 2011, DIS entered into another residential real estate project in cooperation with the hotel operator Four Seasons known as golden oak. Noted author Andrew Ross golden oak as “a very luxurious enclave of three hundred residences” that is “a country club-like” with “concierge services on offer” in his book sun belt sweatshirt.

In other words, this isn’t the first time Disney has explored residential real estate projects as another way to monetize its intellectual property. This is no different from the way Disney makes money from its iconic character, Mickey Mouse, through theme parks, merchandise, and shows.

How will Disney’s latest foray into residential real estate affect its business outlook?

Disney’s entry into residential real estate again with Storyliving from Disney and Cotino should not affect the company’s business outlook in a meaningful way in the near term.

Although DIS did not reveal any quantitative details about Cotino, the company did highlight the Storyliving by Disney website as “not the developer” and “the builder or seller of homes” and noted that developers such as DMB Development are independently owned and operated. . It is reasonable to conclude that Disney may have an agreement with DMB Development to license its intellectual property. But such licensing fees are unlikely to be very large, and there is only one project in the pipeline so far, Cotino.

A major source of DIS revenue may be recurring club membership fees for Cotino or the one-time payments associated with the “Disney entertainment activities” hosted at Cotino that I highlighted in the previous section. In any case, it is unlikely that a single Cotino community will contribute significant revenue that can be compared to what Disney earns from its core theme park business.

It is also understood that Disney did not mention Storyliving by Disney or Cotino at all in the company’s participation in the Morgan Stanley (MS) Technology, Media and Communications Conference or TMT held on March 7, 2022. Likewise, no questions were asked about this Disney business in the Conference.

If Cotino is so successful and Disney plans more comics by the Disney communities and develops other related revenue streams, things could be different going forward. But as it stands now, Disney’s residential real estate business is not expected to be a significant contributor to the company’s revenue or profits anytime soon.

In the next two sections of the article, I focus on Disney’s most recent historical quarterly metrics and its forward-looking financial projections.

Key metrics for stock DIS

Disney’s share price is up +3% from $147.23 as of February 9, 2022 to $152.16 as of February 10, 2022 after the company released its financial results for the first quarter of fiscal year 2022 (fiscal year September 30). The company’s shares subsequently rose an additional +3% to a one-month high of $156.35 as of February 16, 2022. Although the DIS share price eventually corrected to close at $133.64 as of March 10, 2022 in line with market weakness. However, investors were clearly satisfied with the company’s recent quarterly results.

DIS revenue grew +34% year over year to $21.8 billion in the first quarter of fiscal 2022, which was 4% higher than higher market expectations. Disney’s non-GAAP adjusted earnings per share also jumped from $0.32 in the first quarter of fiscal year 2021 to $1.06 in the first quarter of fiscal year 2022, exceeding the bottom line estimate agreed on Wall Street by +67%. . In the company’s first-quarter earnings call for fiscal year 2022, Disney highlighted that “our local parks and resorts generated first-quarter revenue and operating income that exceeded pre-pandemic levels” and that this was the main driver of Disney’s better-than-expected revenue and earnings in the fourth quarter.

Besides delivering stellar revenue and earnings growth, Disney also did well with respect to a key operating metric, Disney+ subscriber growth. The company added +11.8 million new subscribers to Disney+ in the first quarter of fiscal year 2022, which is a significant improvement from the +2.1 million subscribers in net additions it achieved in the fourth quarter of fiscal year 2021. In contrast, its main streaming competitor, Netflix, has achieved (NFLX) Comparatively lower net subscription +8.3 million additions in the same quarter. Disney attributed the decent growth of Disney+ subscribers in the first quarter of fiscal 2022 to a combination of factors, including “new content, our strategic decision to include the Disney bundle with all Hulu Live subscriptions and new market launches” in its latest quarterly earnings summary.

What is the outlook for DIS stock?

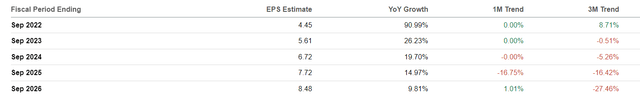

Reviews of Disney’s earnings per share or EPS forecast in the past three months provide important insights.

Revisions to the EPS forecast for DIS in the past three months

Alpha search

On the one hand, sell-side analysts raised Disney’s fiscal year 2022 EPS estimate by +8.7% according to the chart above. This is fitting, as DIS’ Q1 FY 2022 results came in above expectations, and the company’s theme park business recovery from the pandemic appears to be on track.

On the other hand, Disney’s FY 2024, FY 2025 and FY 2026 EPS forecasts saw significant cuts. I think this reflects market concerns that Disney’s larger-than-expected investment in the DTC business will weigh on the company’s overall profitability in the medium term.

More importantly, Disney’s current valuations look fair when compared to its future earnings growth. DIS’ forward FY2023 consensus appears to be FY2023 benchmark P/E 23.8 times more or less in line with its consensus of +20.2% EPS for FY 2023-2025 as stated in Standard & Poor’s Capital IQ data.

Is a DIS stock a buy, sell or hold?

DIS shares are still rated outstanding, as I maintain my views that “Disney’s valuations are not attractive enough” according to my previous article on December 15, 2021. The company’s recent residential real estate project deserves attention, as it represents a new revenue stream for the company. But it is too early to judge the impact of this new business opportunity, as Disney has only one project (Cotino) in the pipeline now, and the company has yet to release significant details about the business economics and revenue model of Storyliving by Disney.