As we enter the third year of the COVID-19 pandemic, some sectors of the hotel industry have recovered, and others are still waiting.

Leisure travel recovered much sooner than most people expected, going from surprisingly strong summer travel in 2020 to a summer of pent-up demand in 2021 to an “all summer summer” in 2022.

Conventional wisdom says that for a true recovery in travel to occur, the travel and hospitality industry needs to return business trips to pre-pandemic levels. When does business travel recover?

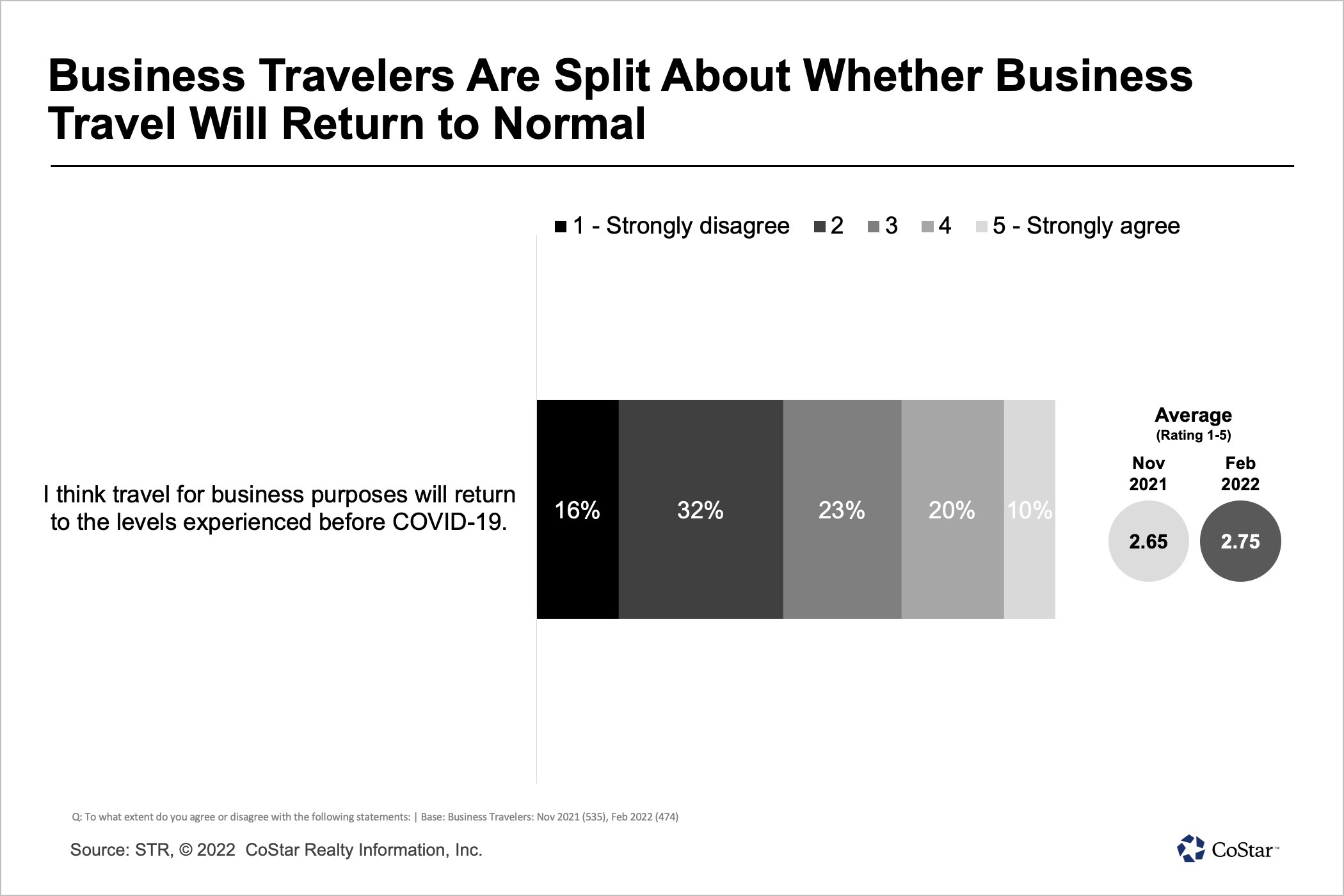

Results from a February 2022 STR survey of just under 500 business travelers around the world suggest that some business travel will return, but not to pre-pandemic levels. When respondents were asked to consider the possibility that they would travel for work now and when the pandemic was over, the results were more negative than positive. More business travel is planned compared to pre-pandemic levels.

STR is CoStar’s hospitality analytics company.

Two-thirds of consumers are less likely to travel to work overnight now, and 43% less likely to travel to work overnight when the pandemic ends – which is of course open to interpretation for every traveler. Additionally, the net propensity to travel, the difference between those who are more likely and less likely to travel, decreased by 59% for business travel today and decreased by 31% for business travel after the pandemic. Among business travelers in the US, business travel intentions weren’t entirely pessimistic, although they were still in negative territory, with net propensity down 24% after the pandemic.

The cost savings that companies will achieve in 2020 with most of their workforce working from home, and the success of using video technology as an alternative to face-to-face meetings are important reasons for this lack of optimism according to STR research conducted last year. In addition, increased efforts to reduce the frequency of travel as a sustainability initiative are gaining momentum.

Negative sentiment regarding business travel was reflected elsewhere in our research. Less than a third of those who traveled for work just before the pandemic agreed that the volume of future business trips is unlikely to resemble pre-COVID-19 levels. On the plus side, this response improved slightly in this measurement compared to November 2021.

Similar pessimistic sentiment for business travel was revealed in February 2022 data from the polling firm Morning Consultation. Nearly 42% of frequent business travelers before the pandemic said they would never get back on the road. Most surprisingly, that percentage is up from 39% when asked four months ago in October 2021.

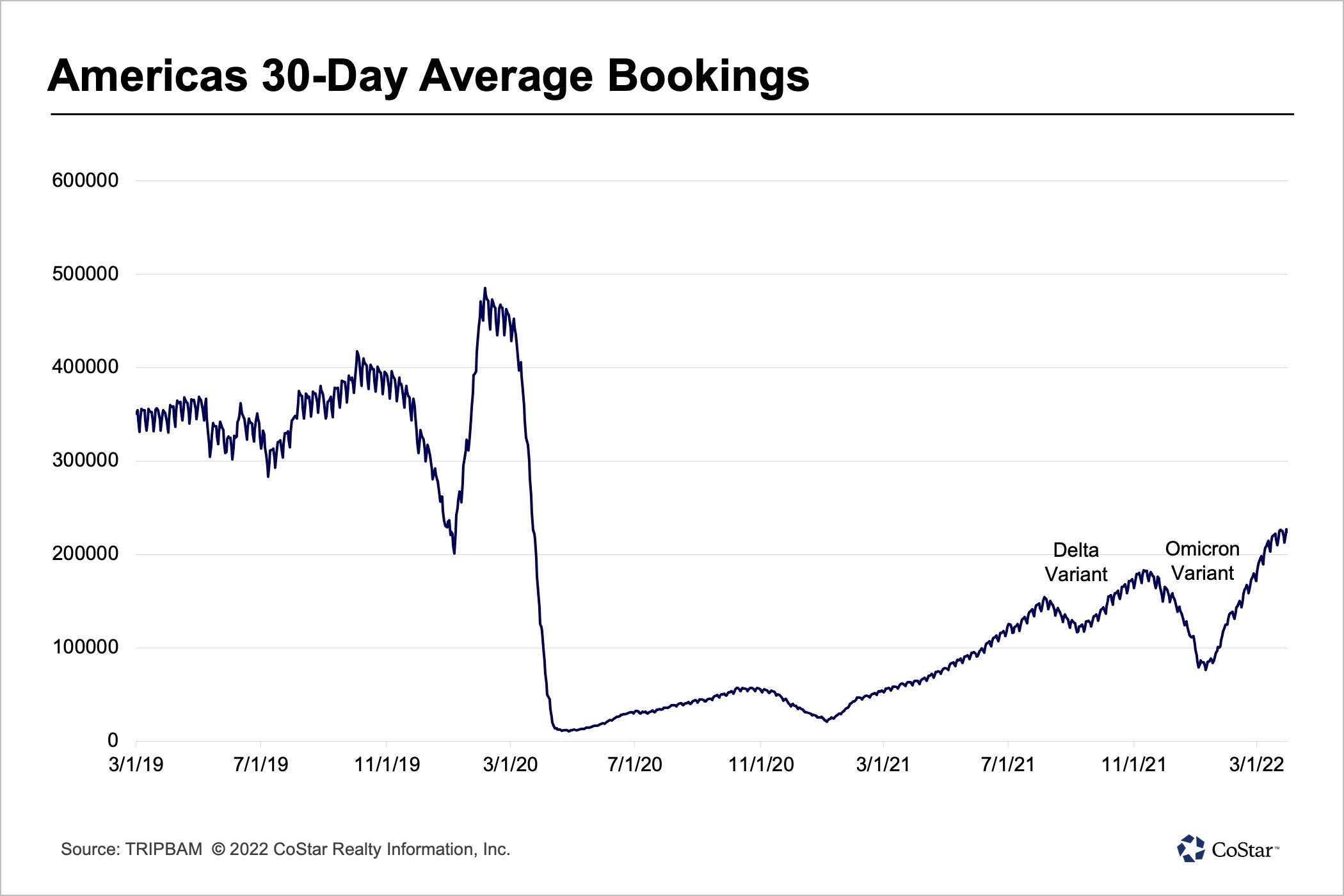

Look at the data from TRIPBAM It shows a positive side to the demand for business travel. TRIPBAM tracks corporate – not leisure or group bookings – bookings made by TRIPBAM’s 2,600 clients in 192 countries. It is estimated that this sample of corporate bookings accounts for between 15% and 20% of all corporate bookings. The trend in corporate bookings since 2019 provides an indication of the pace of business travel recovery.

In the Americas, for most of 2019, TRIPBAM reported a 30-day average of 300,000 to 400,000 bookings per month except for December through January 2020 when bookings declined due to holidays and seasonality. When COVID-19 arrived in the US in March 2020, bookings dropped to essentially zero. The recovery was very slow until 2020 and started going up in 2021 with back steps in September 2021 and January 2022 due to delta and omicron variables.

Since February 2022, there has been a steady increase in average 30-day bookings. If this pace continues, average 30-day bookings could reach 300,000 by May 2022, and if this path continues, bookings could reach 400,000 by fall.

Looking at regions around the world, the 2019 indexed booking volume for the Americas, Asia Pacific, Europe, the Middle East, Africa and Latin America tells a similar story. Volume started to improve in 2021 in all regions except for periods when delta and omicron variables slowed things down. 2022 is shaping up strongly with the aggregate market index as of March 30th at 60.29%, indicating that the industry has recovered by 60% and that number may continue to rise. The Americas, Asia Pacific, Europe, Middle East and Africa are all close to this general indicator with Latin America showing booking volumes at nearly 90% of 2019 levels.

Global consulting firm McKinsey has confirmed a permanent reduction in business trips. newly The New York Times The article stated that the company recently decided to reduce its travel by 25% from pre-pandemic levels.

From an article in January 2022 in Los Angeles Times, the CEO of Southwest Airlines Company was not optimistic, commenting that the return of business flights will be slower than expected. American Airlines expects commercial demand to eventually return, but is “hedging its bets.”

Last Global Business Travel Association Research It is summed up in this title: Business travel recovery keeps gaining momentum. A total of 78% of supplier management and travel professionals in a February 2022 survey said they were optimistic about the path of business travel to recovery, up from just over half who reported being optimistic the previous month.

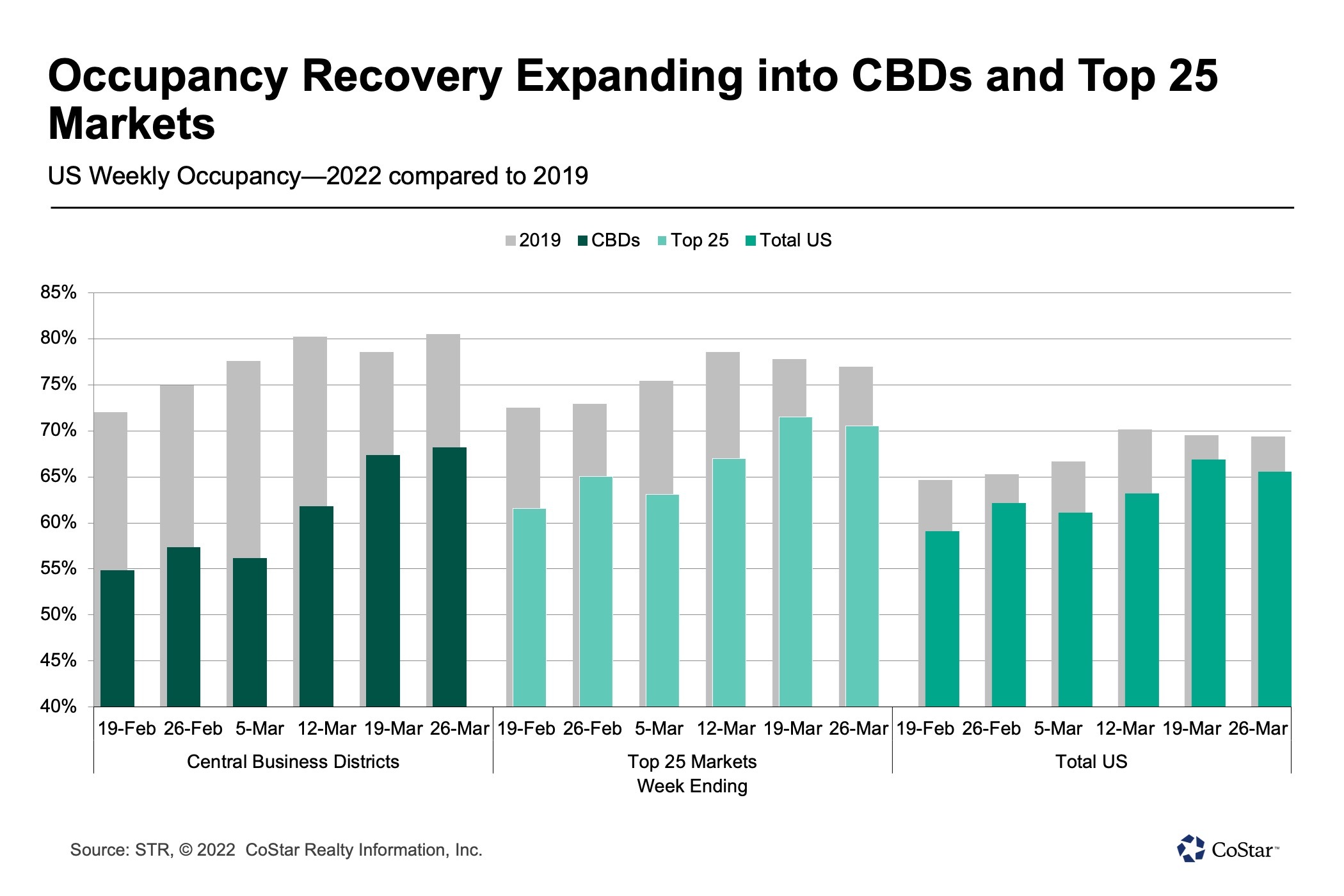

Evidence for the resurgence of business travel is seen in improved occupancy in the central business districts and the 25 most important markets, which are the regions where the majority of business travel demand occurs. Central business districts have been particularly hard hit during the pandemic, and seeing this positive occupancy trajectory in key downtown areas is a sign of business travel optimism.

With so many diverse viewpoints, it’s impossible to know what a business trip return will look like. The only sure thing is that it will look different than business travel in the pre-pandemic period.

Hotels, business tour operators, airlines, and all industries that rely on business travel will need to realize that change is coming. To quote a recent headline “We’ll never go back to normal, but we’ll be back to work” and if work requires face-to-face meetings, business trips will return.

Chris Clauda is the Senior Director of Market Insights at STR.

This article represents an explanation of data collected by STR, the parent company of HNN. Feel free to contact the editor if you have any questions or concerns. For more STR data analysis, visit the Data Insights blog at STR.com. For information on TRIPBAM, contact [email protected].

Return to the home page Hotel News Now.