Andrea Fumbaka/iStock via Getty Images

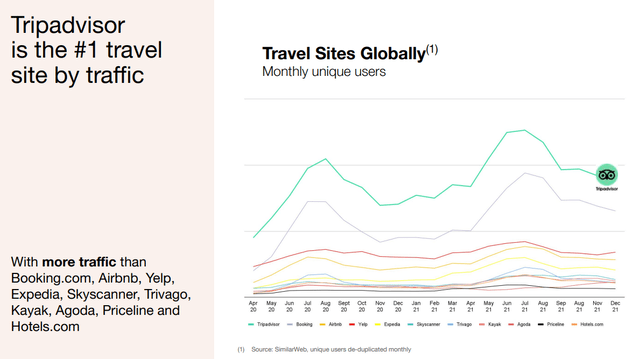

Tripadvisor (Nasdaq: Journey) is a company with great potential. It is sad to see that they are facing a lot of problems monetizing the site. Incredibly, it has more traffic than Booking.com (BKNG) or Airbnb (ABNB). However, the company struggled to find the optimal business model to convert visitors seeking to read reviews into revenue for the company. However, despite lower traffic, the company is generating some revenue and operating cash flow, and we think the stock is pretty cheap right now assuming travel recovers in 2022.

Tripadvisor Investor Presentation

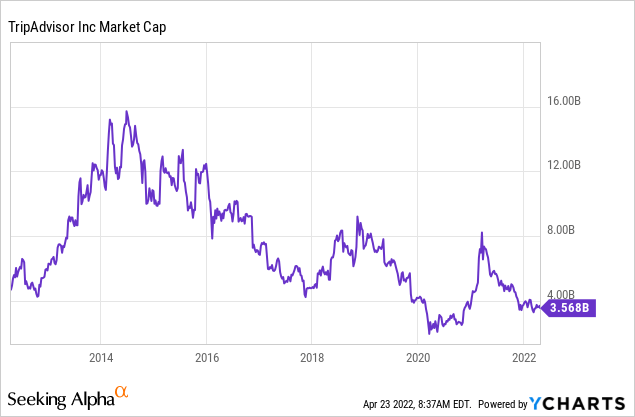

Tripadvisor trades for a market value of barely 3.5% of Airbnb’s, which makes us believe that if the company doesn’t figure out the right business model, someone will likely offer to buy it and discover it on their behalf.

The management has tried to fix the monetization issue by offering a subscription service called Tripadvisor Plus, but so far it hasn’t really met expectations. The subscription, which offered subscribers advance hotel discounts for $99 a year, has faced fierce opposition from large hotel chains over price parity issues. It is currently moving to offer less attractive cashback payments after stays.

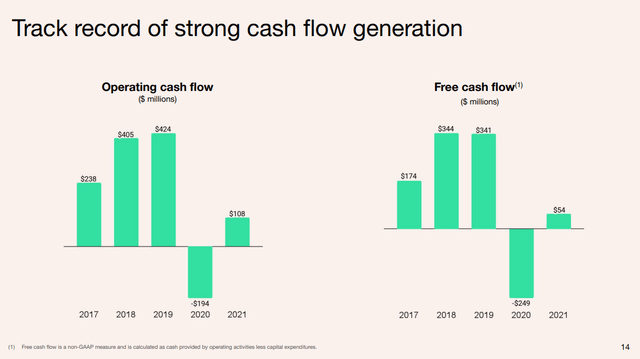

In the pre-pandemic period, Tripadvisor generated more than $400 million annually in operating cash flow, and more than $340 million in free cash flow. Comparing these numbers with the current market capitalization, we see that the company is barely trading at ~10x that cash flow figure. If there is a full travel recovery, the company should in theory be able to generate more profits and free cash flow, given that it took more than $200 million in costs from its post-pandemic cost structure, and said that represented a significant value that should A portion of this savings remains after redemption.

Tripadvisor Investor Presentation

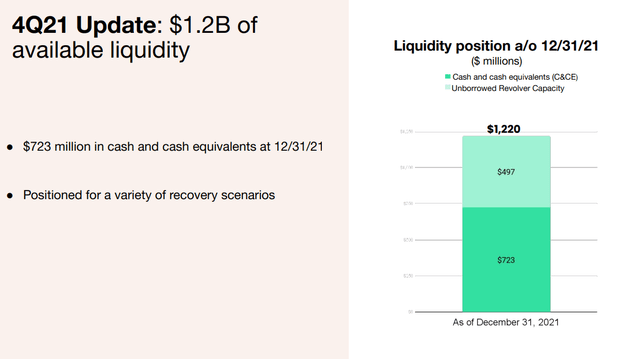

Fortunately, the company has enough cash to wait for the travel recovery to arrive, even if not in 2022, but in 2023 or 2024 instead. Tripadvisor has more than $1 billion in cash and cash equivalents, and the capacity of a non-borrowed pistol.

Tripadvisor Investor Presentation

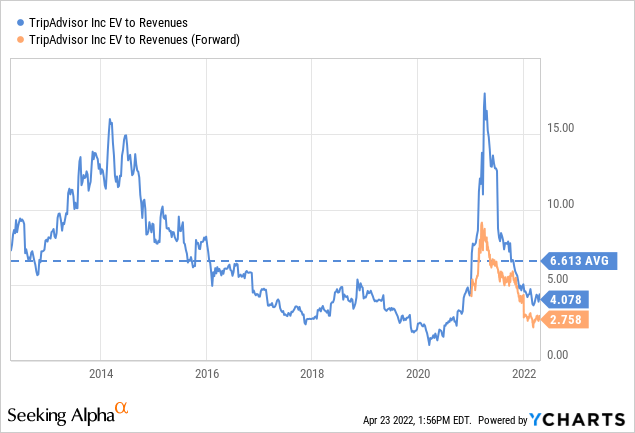

evaluation

We can see how low the rating is by looking at the EV/Revenue multiplier and comparing it to its historical average. This multiplier is one-third below the average, and the forward multiplier is less than half that historical average.

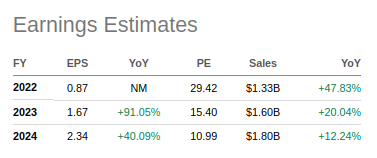

Analysts expect earnings to increase significantly in the next two years. The average FY24 estimate is currently $2.34, giving the FY24E P/E 10.9x.

Alpha search

Growth and potential catalysts

Travel is expected to rebound in 2022 to 2019 levels, which will benefit the company significantly. Especially, as mentioned, thanks to the costs incurred immediately after the onset of the epidemic. The company expects these savings to continue even after full recovery. This would make the company more profitable than it was in the pre-pandemic period.

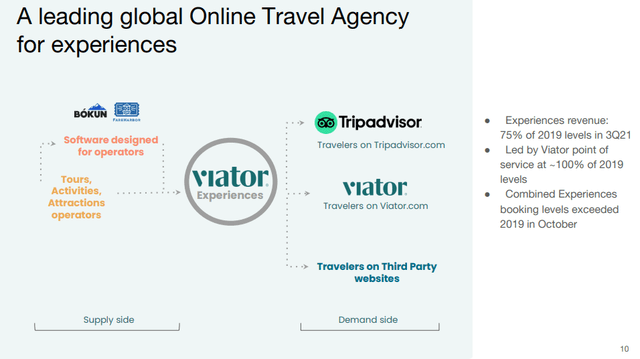

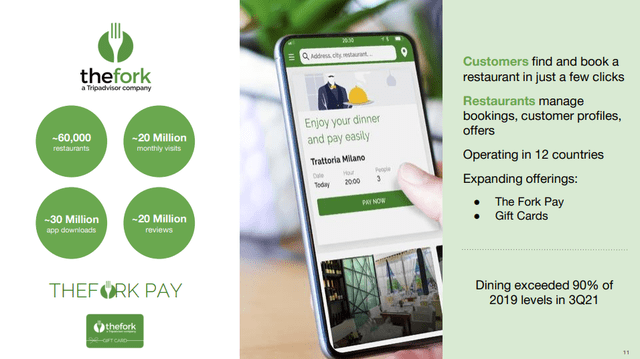

There are other potential catalysts for unlocking value beyond a potential acquisition. One of them will be a successfully redesigned subscription service. While the first attempt at Tripadvisor Plus ran into problems, the company is trying to modify the product and re-launch soon. Two other growth divisions are Viator and LaFourchette. Viator is the leading market for travel experiences and it’s growing at a very good pace. LaFourchette is a restaurant reservation app that operates mostly in Europe, similar to OpenTable in the US market. Both businesses have seen a faster recovery than the main Tripadvisor business. Tripadvisor is also considering selling a minority stake in Viator to general shareholders, with Tripadvisor retaining control of the brand. This can unlock some value and show investors how much this business is worth to the company. Tripadvisor has already submitted a draft confidential S-1 registration statement to the Securities and Exchange Commission.

Liberty Trip Advisor offer

Competitors GetYourGuide and Klook are valued at more than $1 billion, so Viator can definitely move the needle for Tripadvisor. Especially considering that Viator is the leader in the booking experiences segment. Reservation levels trials surpassed 2019 levels in October 2021.

Liberty Trip Advisor offer

TheFork (LaFourchette) operates in 12 countries and partners with nearly 60,000 restaurants to handle reservations for them. It is another company on Tripadvisor that is growing rapidly and may also be considered at some point for an IPO, spin-off or sale.

Liberty Trip Advisor offer

Conclusion

Tripadvisor posts are really cheap, especially if there is a full travel recovery soon. With costs taken out of the business, it is likely to be more profitable than before, and the company is experimenting with ways to better monetize its massive web traffic. There is also the possibility of becoming an acquisition target from another company that has some ideas of how to monetize all the traffic they get. There is also a lot of value in some of the other companies that Tripadvisor owns, such as Viator and TheFork.